Nigerian Youths Benefit from FiBOP’s Financial Education Program

By prince Benson Davies

Finance Business and Online Publishers (FiBOP) has taken a significant step towards empowering Nigerian youths by equipping them with essential financial knowledge. Recognizing the importance of financial literacy in today’s economy, FiBOP’s initiative aims to bridge the knowledge gap and provide young Nigerians with the skills and insights needed to make informed financial decisions. Through this program, FiBOP is not only fostering a culture of financial responsibility but also contributing to the development of a more economically savvy and resilient youth population

The keynote speaker, Mojisola Ogundipe, Senior Manager and Team Lead at AIICO Insurance PLC, delivered an insightful speech and defined and simplified insurance for the youths as a system of protection against financial loss, providing help during accidents, illnesses, or disasters.

She provided a comprehensive overview of insurance, including life insurance, health insurance, vehicle insurance, education insurance, and home insurance, noting that each serves a specific purpose in managing risk and financial uncertainty.

Ogundipe also elaborated on digital payments as the future of money, enabling payments and receipts using phones, cards, or computers.

She outlined popular digital payment methods, including mobile wallets like Google Pay and Apple Pay, bank apps, debit/credit cards, and QR codes.

Ogundipe discussed various investments and said they involve putting money into something to earn more over time.

She mentioned types of investments, such as savings accounts, fixed deposits, mutual funds, stocks, and cryptocurrency, warning that the latter is highly risky.

In his submission, Stephen Alangbo, the Managing Director/Chief Executive Officer of Cornerstone Insurance Plc, has identified trust, knowledge gaps, and cultural beliefs as the most significant barriers preventing Nigerian youths from fully accessing insurance, digital payment systems, and investment opportunities.

Alangbo, represented by Kayode Odetola, Head of Retail, Cornerstone Insurance Plc.

According to Paul Iwunwa, Marketing and Corporate Communications, Cornerstone Insurance Plc, Mr. Odetola, speaking during a panel session, said lack of awareness remains the biggest obstacle to youth adoption of insurance and digital financial tools. “Many young Nigerians have never heard of insurance, and those who have often think it’s a scam. We need to demystify financial services and communicate in a language young people understand,” he said.

He noted that trust is the missing link. “Once trust is established, everything falls into place,” he said, citing the case of fintech platforms like OPay and Moniepoint during Nigeria’s 2023 cash crunch, when traditional banks struggled and alternative platforms proved reliable.

FiBOP President Charles Onwuotogwu, in his opening speech, emphasized the need for youths to understand these concepts to navigate the future financial landscape effectively.

FiBOP President Charles Onwuotogwu, in his opening speech, emphasized the need for youths to understand these concepts to navigate the future financial landscape effectively.

“As the financial sector becomes more dynamic, a better understanding of the sector will aid speedy growth and development, particularly in insurance, which, despite its importance, is grossly misunderstood,” he said.

The experts agreed that insurance protects life and assets, digital payments are the new normal, and investments are crucial for the future.

They encouraged Nigerian youths to adopt these financial practices early in life to drive financial inclusion and secure their financial futures.

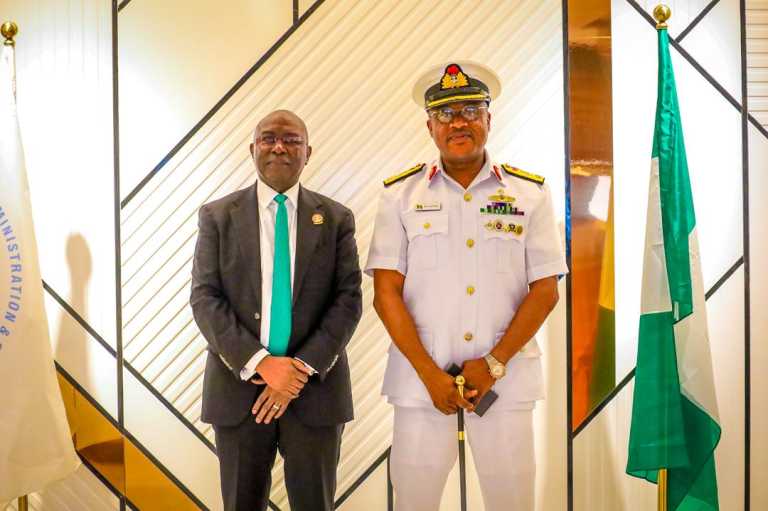

The event was attended by a distinguished group of guests from various financial institutions and organizations.

Mr. Obinna Nwamere, representative of the Chairman, Nigerian Insurers Association, Mr. Kunle Ahmed; Mr. Jackson Ikiebe, Head, IT Operations and Governance, Sanlam Life Insurance, Nigeria, Panel Session Moderator; Dr (Mrs) Chizoba Ehiogu, Rector, College of Insurance and Financial Management (CIFM), Miss Mojisola Ogundipe, Senior Manager and Team Lead, Persistency, AIICO Insurance PLC, Keynote Speaker; Dr. Gbenga Falana, representative of Prince Babatunde Oguntade, President, Nigerian Council of Registered Insurance Brokers (NCRIB); Mr. Kayode Odetola, Head, Retail, Cornerstone Insurance and Mrs Chdinma Emena, representing Moniepoint CEO, Mr. Tosin Eniolorunda during the panel discussion at the 2025 Finance and Business Online Publishers Association (FiBOP) Youth Capacity Building and Empowerment Programme held at MUSON Centre, Onikan, Lagos on Tuesday, April 15, 2025.

The New Experience Newspapers Online News Indepth, Analysis and More

The New Experience Newspapers Online News Indepth, Analysis and More