First Bank Accused of Recklessness, Abusing Court Process

By Our Correspondent

General Hydrocarbons Limited has fired back at First Bank, dismissing allegations of fund diversion as baseless and without merit. The company has accused First Bank of recklessness, which it claims almost resulted in the loss of 93 lives on one of its rigs.

A press statement signed and made available to newsmen by GHL management recently.

The company is giving clarifications on some of the allegations raised by the bank, among which is diversion. The company management said GHL contracts and invoices were vetted and paid by FBN through their Credit and Risk teams directly to all service providers.

In the statement, GHL said “FBN’s repeated failures to pay on time within the contractual framework of 5 days, which became up to 70 days or not at all, in a clear breach of its Tripartite Agreement obligations as captured below:

“The Bank shall, where GHL has satisfied

all conditions precedent to disbursement

under the Facility Agreement, disburse all of or part of the Facility Amount to GHL not later than 5 (five) Business Days after GHL makes a utilisation request by the terms of the Facility Agreement

“This failure to pay GHL pending request as per above terms led to an international incident on October 7, 2023, when the drilling rig, Blackford Dolphin, ran out of fuel, food, water, and other critical supplies with 93 souls on board, and the Rig was on the verge of declaring MAYDAY.”.

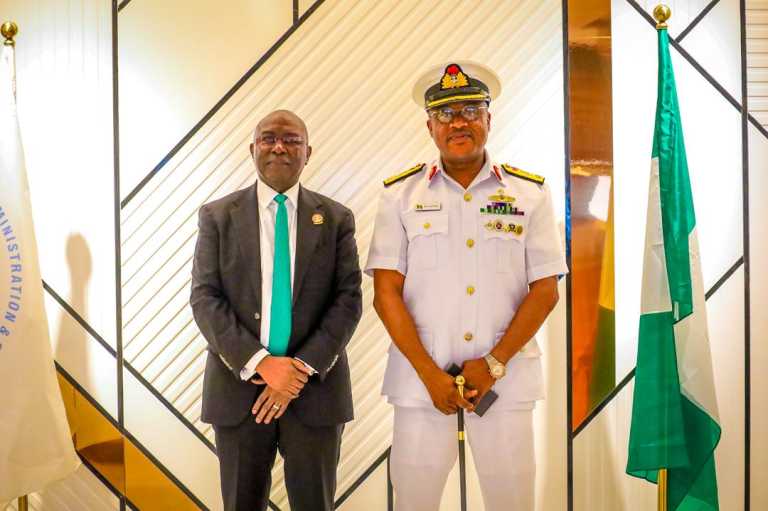

According to GHL management, the Managing Director and Executive Director of FBN were abroad, and the current Managing Director, Olusegun Alebiousu, who was then the Chief Risk Officer (CRO), was acting for the Managing Director, and GHL brought this matter to his urgent attention. He then worked the phone, calling suppliers and service providers one after the other and promising payment within 3 days. Based on FBN’s assurances, the service providers made emergency supplies, but the payment never came.

The management said “to ensure safety of life and continuing security at 75KM Offshore Nigeria, GHL had to enter an irrevocable third-party payment order with one of the ofhakers to pay the suppliers directly, which stabilised the operation. FBN was later given evidence of the payments made.

“That is what FBN calls diversion.

We will meet FBN in court with daily reports and log details to debunk this continuing misinformation of diversion.

GHL acted to save 93 souls, most of them foreign nationals, who had begun contacting their embassies and home governments, and to save Nigeria from an international incident offshore Nigeria.

“We are ready, willing, and able to present the body of evidence to any court, including the continuing non-payment to Century FPSO and other service providers by FBN despite repeated demands in line with signed agreements.

“Indeed, we had to cough out our cash as reflected in our audited financial statements to keep the project afloat or go to court to seek protective reliefs.”.

On abuse of court process and failing to comply with a valid court order, According to GHL management, FBN claimed they went to court on a different matter regarding the Facility Agreement. But Justice Ambrose L. Allagoa had given his judgement after hearing both sides on the Facility Agreement, amongst other issues, on December 12, 2024. “That an order is granted, restraining the Respondent (FBN) either by itself or acting through its servants, agents, assigns, privies, and affiliates howsoever described, including any persons claiming under its authority from making any calls or demands or taking any steps whatsoever to enforce any security, receivables, instrument, finance documents or assets of the Applicant (GHL) which have been charged as security for the facility agreements in respect of the Applicant’s operation of OML 120, including but not limited to the side letter, and the amended and restated agreements between the Applicant and the Respondent pending the hearing and determination of the arbitration proceeding.

The New Experience Newspapers Online News Indepth, Analysis and More

The New Experience Newspapers Online News Indepth, Analysis and More