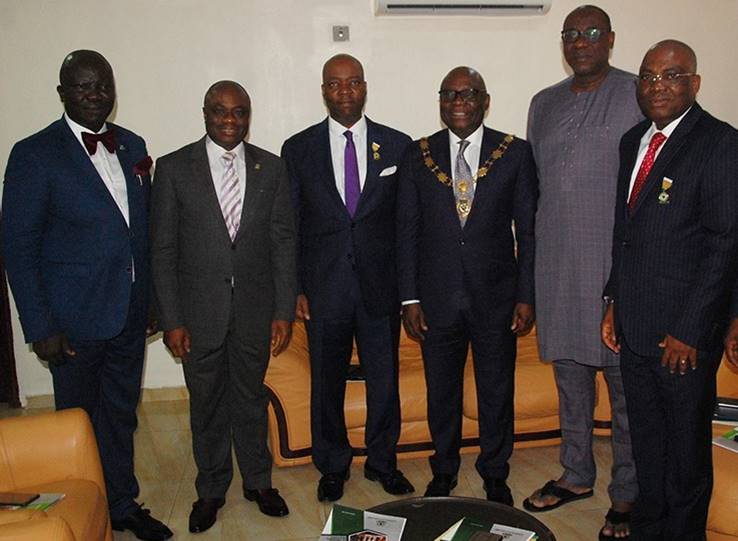

Registrar, Chief Executive, Chartered Institute of Bankers of Nigeria (CIBN), ‘Seye Awojobi (left); second Vice President, Ken Opara; Managing Director, Ecobank Nigeria, Patrick Akinwuntan; President/Chairman of Council, CIBN, Uche Olowu; Deputy Governor, Operations, Central Bank of Nigeria, Adebisi Shonubi and first Deputy President, Bayo Olugbemi at the 2019 CIBN Graduates’ Induction in Lagos.

Managing Director, Ecobank Nigeria, Patrick Akinwuntan, has urged bankers in the country to make deliberate efforts to reposition their skillsets and knowledge-scope in order to meet with the challenges of a fast-changing business environment and marketplace.

Akinwuntan, who spoke at the 2019 graduates induction & prize award ceremony of the Chartered Institute of Bankers of Nigeria (CIBN), in Lagos gave the advice in his presentation titled: “Repositioning for Relevance in a Competitive Environment”.

He said the banking sector was undergoing significant disruptions in a bid to remain relevant, increase convenience and productivity, while ensuring that banking remains simple for individuals and businesses alike.

He stressed that bankers should respond through repositioning, adoption of and adaptation to potentially disruptive technologies in their career models and strategies.

“The banking sector has undergone some changes, but I have news for you; it will undergo further disruption. Yesterday, we had nothing like the digital apps in use today; tomorrow, we are certain of further disruption underlined by artificial intelligence, machine learning, robotics, big data analytics among others. We must therefore brace up for these competitive threats.”

Akinwuntan also explained that Ecobank Nigeria, which is a member of the Togo-based Pan-African bank group, Ecobank Transnational Incorporated (ETI) is already repositioning its entire workforce for the Millennial age through various trainings, skills development and capacity building, stating that the Bank has made many pioneering achievements and ‘firsts’ across various products and digital platforms in the country in line with its repositioning efforts.

“Only recently, the Chartered Institute of Bankers of Nigeria (CIBN) accredited our state of the art training Academy which runs the Entry Level Development, Graduate and Management Trainee programs.

This is in addition to other local and foreign trainings for our staff. All these efforts are to further enable the Bank to take up its rightful position as the Bank of choice in the industry.”

He specifically commended CIBN for the various initiatives targeted at raising standards, promoting ethics and positioning the financial services industry to meet with the new challenges such as digital banking and financial technology (Fintech), adding that the Institute is also contributing meaningfully towards the economic development of the country.

For the new inductees, Mr. Akinwuntan urged them to imbibe the core values of integrity, courage, diligence, ethics and professionalism, stressing that these must be accompanied by execution and discipline in order to make a sustained positive impact.

“Today, we know who a banker is and what the banker does, but do we have equal clarity of who the banker and indeed bank of tomorrow will be? Increasingly, banking is what you do and not where you go. This is why some people are of the opinion that banking is needed, but are bankers are needed?

Meanwhile, the customer level is also being redefined around account based customer and transaction based customer.”

“Personal and professional repositioning requires vision, unflinching self-belief, courage, diligence and the willingness to dare. You are the next wave of professionals set to redefine Nigeria and its economic landscape, you must rise to the occasion by fulfilling that promise.”

President of CIBN, Uche Olowu, said it was pertinent to mention that the increasing competition in the digitised banking environment would no longer be between banks but with non-banking institutions.

According to him, “Fintech and big tech firms such as Google, Amazon, Facebook and Apple are now capturing more of the banking value chain. Furthermore, payment service banking is set to further disrupt the banking industry.

“For example, as of July 2019, telcos such as MTN and Airtel Nigeria had been granted licences by the Central Bank of Nigeria. PWC suggests that from 2025-2035, a market economy would readily exist without traditional banks.

He submitted that operators and professionals must reposition for relevance in the changing environment.

The New Experience Newspapers Online News Indepth, Analysis and More

The New Experience Newspapers Online News Indepth, Analysis and More