Destination Inspection: The Key to Unlocking Seamless Trade Facilitation

As the world continues to grapple with the complexities of international trade, Destination Inspection has emerged as a beacon of hope. It offers a seamless and efficient way to facilitate trade and promote ease of doing business.

Group Managing Director of Widescope Group of Companies and the Chief Executive Officer of Global Transport Policy, Dr Oluwasegun Mutairu Musa, is a maritime expert, transport planner, security consultant, forensic investigator and career diplomat in this interview with The New Experience Newspaper, x-rayed the Nigerian maritime industry, especially the freight forwarding segment, insisting that idespitethe milestones recorded in the sector, a lot more needs to be done to maximize its full potential for the benefit of the nation’s economy.

Can you kindly let us into your place of birth, education and professional career?

Sure! My name is Dr. Oluwasegun Mutairu Musa. I am from Badagry in Lagos State. I am a transport planner and a career diplomat by training. I am a security consultant the Group Managing Director of Widescope Group of Companies and the Chief Executive Officer of Global Transport Policy. I had elementary and secondary schools in Badagry and attended Olabisi Onabanjo University, Ago Iwoye, Ogun State and obtained a Post-Graduate Diploma (PGD) in Maritime Technology at the Federal University of Technology Owerri (FUTO). I also did a PGD in Transport Planning and specialized in Shipping and Petroleum Management at FUTO. I proceeded to the Lagos State University (LASU) where I did another PGD in International Relations and Strategy Studies. I also obtained a Masters degree in International Relations and Strategy Studies and another Masters in Transport Planning. Thereafter, I specialized in Security and Infrastructure Protection from the University of Lagos (UNILAG) and I am a Forensic Investigator by training.

Let’s come to the maritime industry where you operate. How do you intend to address the challenges faced by freight forwarders and logistic operators in Lagos State?

The challenges faced by freight forwarders in the Nigerian maritime industry are numerous and so I think we can just itemize them one by one. We are talking about capacity building. People who specialize in that field need to be well informed. They need to build capacity. They need to align to international best practices. We need to depart from the archaic modus operandi and embrace the modern global best practices. The challenges are numerous. We are talking about inconsistency in government policies affecting most of the trading activities. We are talking about the ports and road infrastructure and we have so many challenges. So, we have to start addressing them one by one.

Number one is that the Nigerian government needs to encourage indigenous capacity so that they can also compete favorably with their counterpart from abroad, otherwise they, the foreign multinationals will dominate the business and that’s what we are all experiencing now.

Before a typical indigenous forwarder gets a job, the foreigners, multinationals like UPS, have gotten so many. So the government needs to give us that platform to compete favorably with the foreigners in terms of supporting us with liquidity to expand our business and build capacity. The foreigners have the capacity because their home countries are supporting them. They have access to credits. So for us to be competitive, the government also needs to support us. They need to create a platform for us to identify the genuine forwarders so that we can also access liquidity that we can use to position ourselves strategically to compete.

We also need to look at expediting the clearance process in the ports. Ordinarily, a port is supposed to operate 24/7. And unfortunately, because of insecurity and so many other things, we are unable to achieve that.

So, by and large, the government needs to look into that so that there won’t be congested warehouses where cargo will be stuck and won’t be able to go out the next day and you’ll have to wait till the next day, you pay storage and

all other available charges that’ll be passed on to the goods when it exits the ports.

And that’s why you see inflation every day. But whatever you incur in bringing in your shipment and clearing your shipment will also be factored into the final cost of the goods when they eventually get to the market. So we’re supposed to operate 24/7 port operations. And we’re also supposed to have an enabling environment for more businesses to thrive. The government also needs to create more warehouses, especially specialized warehouses, which we are planning to key into. We want to have warehouses. We are coming up with ideas and we’ve been speaking with government representatives on specialized warehouses that deal with only coaching.

We are one of the top operators of coaching in Nigeria. We’ve been talking to the government to give us space and the necessary backing so that we can establish our own warehouses that will specialise on coaching at the airports.

What are your thoughts on the African Continental Free Trade Area (AfCFTA) and the impact on Lagos State and the economy?

The African Continental Free Trade Area (AfCFTA) is a Continental Trade hub that allows all 54 member countries and signatories, among others, to have a kind of robust economy. That will help to revamp their economies and reposition them strategically to be able to compete with their counterparts in the European, American and Asian economies. Because the AfCFTA has the largest market considering the population of the countries involved, but unfortunately, we don’t have the market. Only a few countries are prepared to participate and benefit from that platform. In Nigeria, for instance, we don’t have the capacity to participate in such a way that it will benefit our economy. It’s rather unfortunate that most of the African countries are prepared and they have commodities to exchange on that platform, but in Nigeria, we don’t have commodities to exchange because our local capacity has dropped drastically. If you look at most of our production, we cannot even satisfy our local consumption. And the international trade rules state that you must satisfy your local consumption before you satisfy your expert consumption, otherwise it will cause hardship because failure to meet local demand could lead to inflation. Since the Nigerian authorities do not even know what to trade in that market, the country may end up being a dumping ground.

Nigeria has been experimenting on various systems to facilitate efficient transactions at the nation’s ports, yet congestion and delays persist. What’s your assessment of the situation?

Nigeria loves litmus tests and the government is not consistent in policy formulation and implementation. It appears the government does not understand what to do. And that is why when we have a system it must be supervised by people with a wide pool of knowledge, those who know what to do. Both at the legislative and executive levels, it is expected that those elected into positions will have ample knowledge to help propel the country in the right direction towards economic growth and development. In the absence of that we find ourselves in situations like this without direction.

We have experimented with pre-shipment inspection in the past and some complained that it was a waste of money. They preferred destination inspection and we commenced destination inspection, people said the government should introduce cargo tracking notes that will tell us what is inside the shipment when it arrives. I call that intellectual fraud. Cargo tracking notes is the same as pre-shipment inspection because the notes will state the outcome of examining the cargos before they are shipped to Nigeria. This is duplication of functions and costs and whoever is promoting this is committing intellectual fraud.

How do you think the government can make the tax payment process easier and more convenient for business and individuals in Nigeria

That’s another fraud. This tax regime is another fraud. Do you know as we speak, Nigerians pay the highest tax worldwide. We pay the highest tax worldwide. Under the local government, we are paying almost about five to six taxes. Under the state, we are paying almost about twelve taxes. Under the federal government, we are paying almost about seven taxes. That’s what we are paying presently. But they don’t want people to know that we are paying multiple taxes. They now say, okay, we want to combat it so we now increase the VAT from 7.5 to 10. Later, we migrate from 10 to 15 until we get to 25 VATs. They say the normal tax, that one we increase to, it’s 10 now, we want to increase to 15 I guess. That does not stop states from collecting their own taxes and it does not stop local government from collecting their taxes and it does not stop them when you are building your house from paying tax. It does not stop you from paying land use tax. It does not stop you from paying construction tax. It does not stop you from paying all those multiple taxes here and there. TV and radio tax. It does not stop. So, why people in the area saying they are paying taxes, they are paying taxes. I use to laugh because they are not even paying half of taxes. The reason why people don’t know we are paying multiple taxes is because it’s only the corporate bodies that identified that most of these taxes they are paying. Those individuals don’t know we are paying tax. We still have withholding tax. and 2020 Federal Inland Renew they are withholding 27 million withholding tax from my money. I’m still paying their tax every year but my 27 million tax is still with them. They say in case I didn’t pay one year and they are not returning my money back to me. The money is still there 27 million would have done a lot in my business. You are not supporting with liquidity. You are still taking withholding. So a lot of people don’t know we are paying multiple tax in Nigeria. So every time government introduces a new tax we say yes, you Nigeria is supposed to pay now come and see what we are paying abroad. I told them go and bring what you are paying abroad let me bring what I’m paying in Nigeria. So I have to know that what you are paying abroad is peanuts and even abroad interestingly their tax regime is so flexible. If I’m to pay government tax if I’m eating in a restaurant, all the food I eat in a restaurant, I collect my receipt. All the Uber I’m taking, I collect my receipt. If I buy water in my office, I collect receipt. If I take my children for excursion, I collect receipt. If I go on tourism, I collect receipt. All those receipts, I will deduct it from my income before I pay government tax. Who does that in Nigeria? withdraw from the source. They tell you this one is your lifetime. It doesn’t consign on soon. You have to pay us. So what they’ve just introduced that they say oh we want the down trodding not to pay tax. We want the corporate bodies to be paying the big tax because they are making money. They’ve forgotten that me I’m a corporate body. You want me to pay big tax, I will pay. I will put it in my service charge and I’m into manufacturing, I will put it into production cost. It’s the same down trodding that will still pay the tax, not me. And if it’s not convenient for me again, I close shop. I migrate to another country that is more flexible to operate my business. And who is losing? You see, any government that cannot tax their brain, they will tax their people. And that’s what we are facing. We don’t have government that can tax brain. That’s why they are taxing the citizens. And the corporate citizens. And when you continue taxing, taxing, a lot of businesses will be folding up. A lot of businesses will be folding up. Then you’ll be left with little businesses. You now put too much pressure on them, they start cutting corners. You want to buy beverage, you just see that you open the can of Bormita, you see that what you’ll meet inside is half. You open the can of Pikmik, you see that what is the liquid inside the can make is half. That is how to cut corners. Because everybody must maximize their own income. But they have bills to pay. We are paying bills. On a daily basis, if we start full operation here, we run 600,000 every two weeks, less than two weeks. 600,000 in this office. Every ten, eleven days, we run 600,000 in this one. Which account is that one going? Because government is not giving me light. There’s a lot that government is supposed to be doing, they are not doing. We are doing it on our own. Still, you are increasing your taxes. You are not saying, oh, you put in production, you put in service areas, how do we support you, so that at least you’ll be able to compete, so that at least you see, what people don’t understand is this. When you fail to build indigenous capacity, you end up reducing your income. Just like government often say annually, the customer must increase their revenue. We are giving you more targets every year, more targets every year, more targets. Each time they give targets to customs, they are killing the economy. The implication is, in any normal climate, if customs revenue increased, import revenue increased, every citizen in that country will start crying. Any year that customs import duty revenue increase, all the citizens will start crying. Every single protest is an indicator, indication that the economy has collapsed. That means there is no more production again. That is the implication. Sir, sir, sir, the customs are always Do you know the implication is, number one, the customs are not promoting export because you don’t have anything to export. They don’t depend on imports. They don’t tell everybody, bring anything you want to bring. Anything you want to bring, bring it in. Just pay customs duty. When you pay customs duty, the clothes I am wearing, probably they are supposed to be in it here in Nigeria. The textile companies have collapsed. So I will bring it in. This table, I bring it from Turkey. This computer, I bring it from Japan. This plaque, I bring it from London. This file, I bring it from France, so on we cannot survive as a nation in this way Nigeria’s Corporate Social Responsibility landscape has been undermined by government agencies, which have turned these initiatives into avenues for fraud and embezzlement.

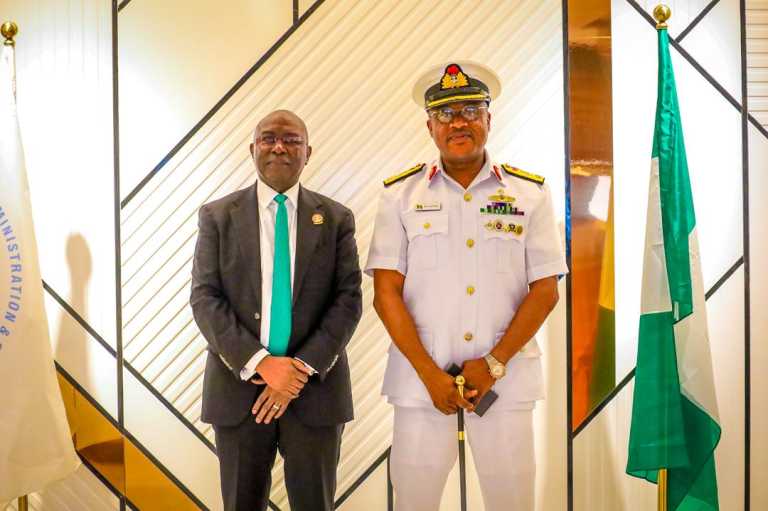

The climax of the interview was the prestigious award presentation to Dr. Segun Musa by Prince Benson Davies, publisher of The New Experience Newspaper. The award honored Dr. Musa’s exceptional contributions to Nation Building,Maritime Development, and Community Service, recognizing his selfless dedication to humanity and society.

The New Experience Newspapers Online News Indepth, Analysis and More

The New Experience Newspapers Online News Indepth, Analysis and More