Boosting Depositor Confidence: NDIC, NIBSS Partner on Reimbursement

By prince Benson Davies

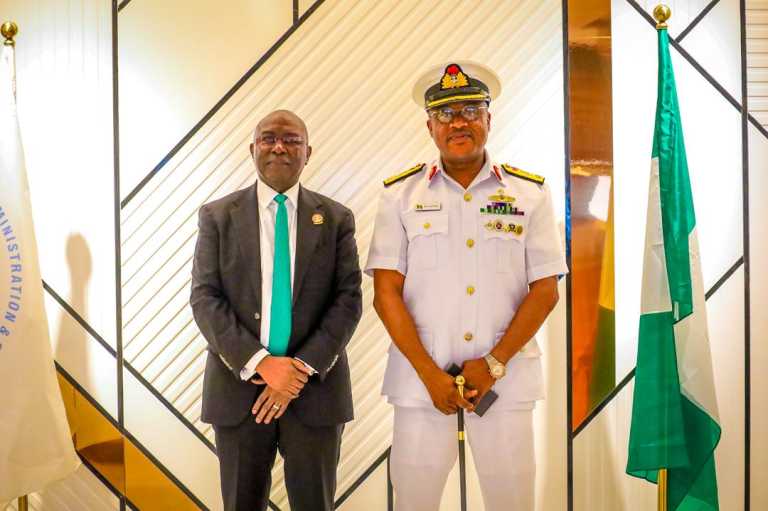

The Nigeria Deposit Insurance Corporation (NDIC) and the Nigeria Inter-Bank Settlement System (NIBSS) Plc. are set to sign a Memorandum of Understanding (MoU) aimed at ensuring a more efficient process of reimbursement of depositors in the event of bank failure. This development was disclosed by the NDIC Managing Director/Chief Executive, Mr. Thompson Oludare Sunday, during a courtesy visit to the Corporation’s Head Office in Abuja by the NIBSS Executive Management team led by its Managing Director/Chief Executive, Mr. Premier Oiwoh.

The MoU is expected to usher in a new era of digitized, responsive, and technology-driven depositor reimbursement process, ultimately reinforcing confidence in Nigeria’s financial safety-net framework. The partnership will enable real-time synchronization of NDIC’s deposit registers and electronic records, allowing for swift verification of eligible accounts during bank resolution.

The MoU is expected to usher in a new era of digitized, responsive, and technology-driven depositor reimbursement process, ultimately reinforcing confidence in Nigeria’s financial safety-net framework. The partnership will enable real-time synchronization of NDIC’s deposit registers and electronic records, allowing for swift verification of eligible accounts during bank resolution.

The NDIC MD/CE highlighted key areas to be covered by the MoU, including expansion of disbursement channels for depositor claims to include Mobile Money Operators (MMOs) and possible NDIC-branded mobile interface. He commended NIBSS for its longstanding partnership and invaluable contributions to strengthening the Corporation’s mandate of protecting depositors and enhancing public confidence in the banking system.

The NIBSS MD/CE, Mr. Premier Oiwoh, expressed appreciation to the NDIC leadership for the sustained partnership and reaffirmed NIBSS’s full commitment to supporting the Corporation in the delivery of its mandate of depositor protection. He emphasized the critical importance of prompt and efficient reimbursement during bank failures, noting that the NDIC’s efforts in this regard directly contribute to public trust and financial inclusion.

The partnership between NDIC and NIBSS is expected to enhance the stability of the financial system and reinforce confidence in the banking sector. The MoU signing is a significant step towards ensuring that depositors’ funds are protected and that the financial system remains stable and secure.

The New Experience Newspapers Online News Indepth, Analysis and More

The New Experience Newspapers Online News Indepth, Analysis and More